Morson Launch IR35 Contractor Report

IR35: THE INFORMED APPROACH | CONTRACTOR SURVEY AND REPORT

Do the majority of contractors deem themselves inside or outside of IR35?

How contractors are determining their status?

How many contractors have considered or are even aware of IR35?

What do contractors want from their agency and the end client?

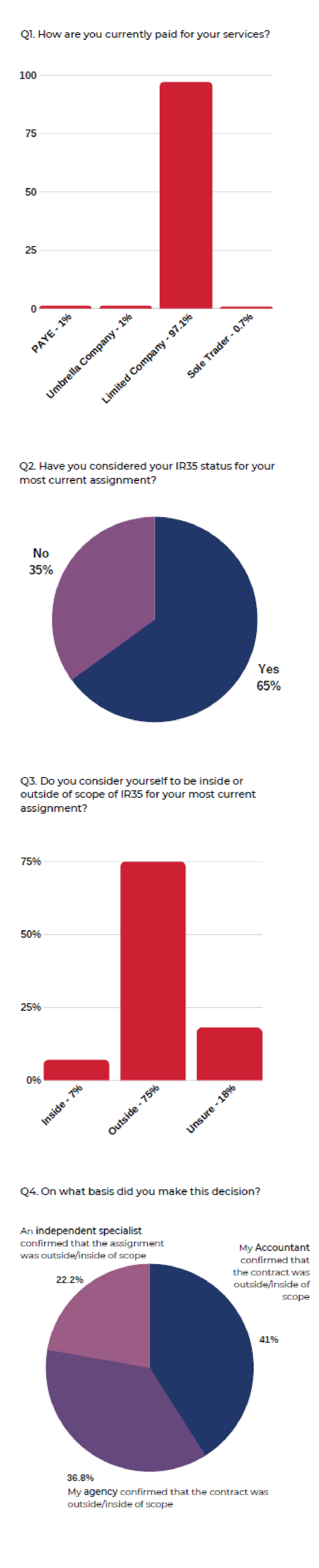

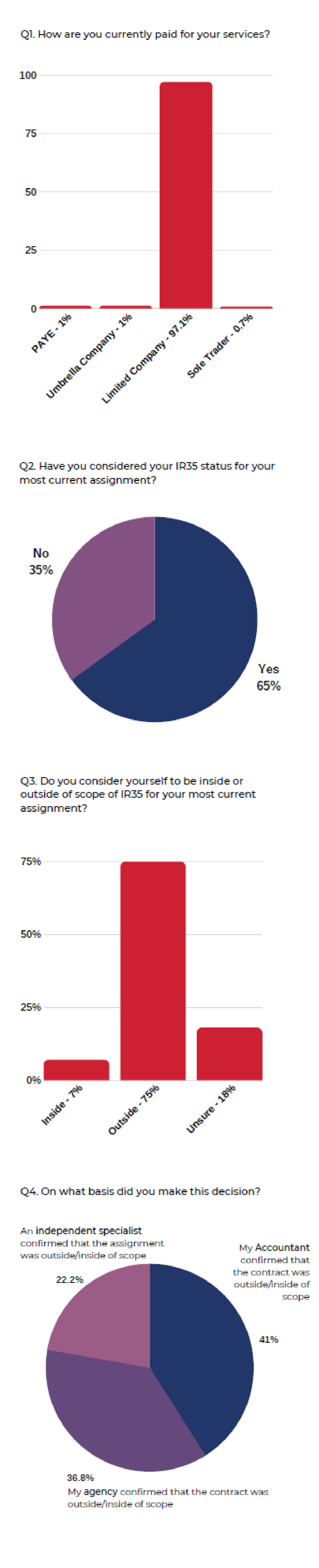

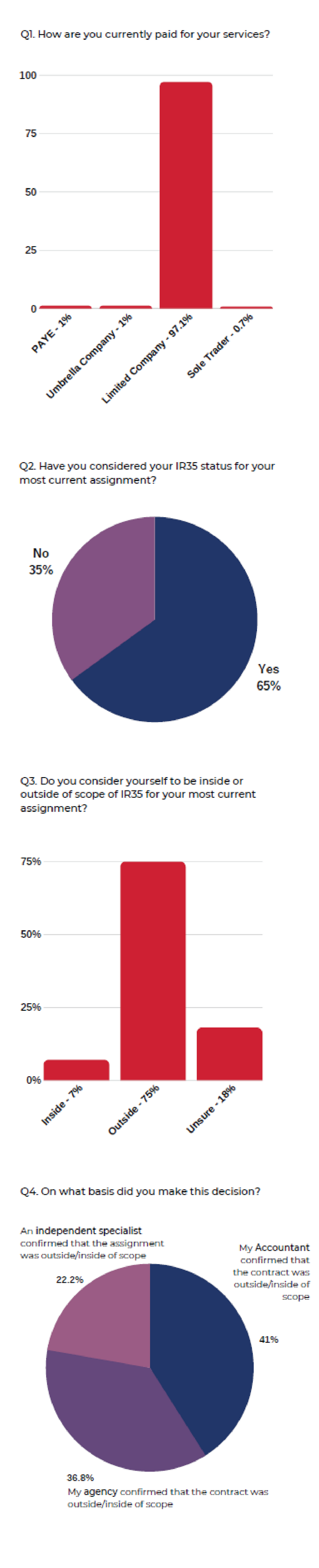

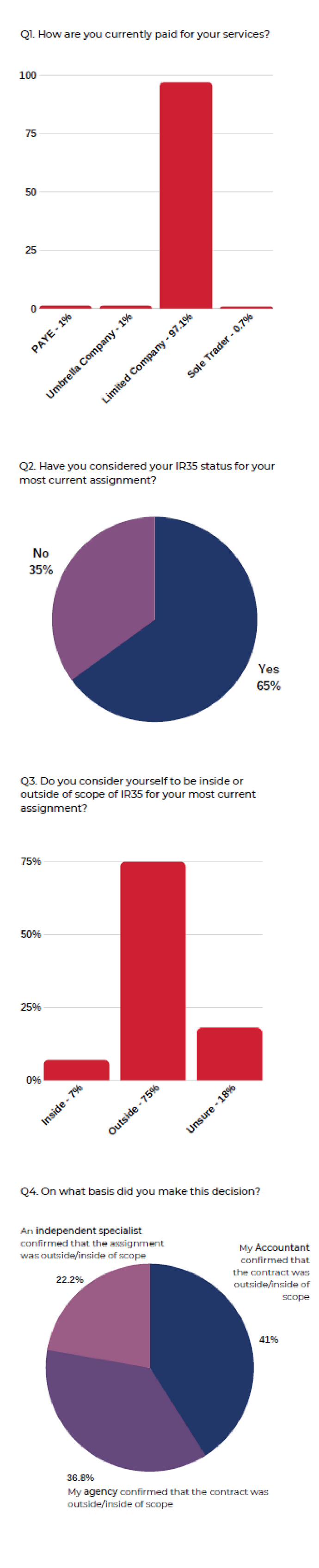

We recently surveyed over 1,000 contractors in our community, of which, almost 97% revealed that they operate through their own Limited company. Discover how prepared the contractor community is and what their concerns are, regarding the impending changes to off-payroll working.

Are contractors considering their IR35 status?

With the private sector implementation date very much confirmed for April next year, our survey results show that IR35 confusion is still prevalent among the contractor community, particularly around understanding whether they are deemed inside or outside.

Out of 1,200 contractors, almost 97% operate through their own Limited company, yet of these, more than a third (35%) have not considered their IR35 status within their current assignment.

From those who did answer yes to ‘have you considered your IR35 status?’ a quarter (25%) of these then went on to say that they were either inside or unsure of their status.

How are contractors currently making IR35 determinations?

Unsurprisingly, 75% of contractors surveyed considered themselves to be ‘outside scope’ of IR35 (an indicator of IR35 status as being a genuine contractor. Outside scope means the contractor is a genuine business and is therefore operating outside of the IR35 rules) on their current assignment, with only 7% deeming themselves to be ‘inside scope’ (an indicator of IR35 status as being an employee for tax purposes. Being ‘inside IR35’ means that the contractor is considered an employee of the end client and therefore is subject to PAYE) and 18% are still unsure about their status.

The largest proportion of contractors who deem themselves inside or outside of scope are currently making these determinations through their accountants (41%). With a further 37% using their agency and 22% of contractors using an independent specialist to confirm their status.

It is clear that better education is needed, with more than half of all those surveyed saying they don’t understand how to determine their own IR35 status and a further 40% are completely unaware of the upcoming reforms.

Top contractor queries and concerns

600 respondents left detailed questions, from these queries we have detailed the overarching sentiments of the contractor community.

We will be producing responses to some of these queries as part of our ongoing commitment to supporting both our end clients and contractor communities through this change in IR35 legislation.

Contractors are concerned that changes to IR35 legislation in the private sector signals major disruption to the market over the next 12 months. Contractors are interested to know how agencies and end clients are working together to mitigate this disruption. Many were asking for guidance and more information on the changes and how to ascertain their status.

Contractors main concerns surrounded if they will end up at a financial disadvantage post-April 2020 and that end clients will follow the public sector and go for a ‘blanket’ approach, deeming all contractors to be inside IR35. Many contractors questioned whether these changes to IR35 signalled the end of contracting all together and 10% indicated they are looking to leave contracting or looking for work abroad as a direct result of IR35.

What does this mean for end clients?

Based on the results, privately-run businesses will likely have a number of contractors that are operating through their own Limited company, yet are deemed inside of IR35 legislation. Failure to identify these individuals and put proactive measures in place to determine whether a contractor falls within the scope of IR35 could see you become liable for paying back tens, if not hundreds of thousands of pounds in unpaid tax.

Communication is key. As of April 2020, you, the end client must make sure that you inform the worker of the IR35 determination of their assignment. The contractor will be entitled to ask the client for information on IR35 status and challenge IR35 decisions, HMRC expects end clients to put in place a mechanism to allow a contractor to challenge a decision.

It’s crucial that you begin to prepare for the April 2020 deadline now. We’ve partnered with IR35 specialists, Champion Contractors and Weightmans LLP, to ensure our clients have access to the specialist knowledge and experience needed to remain compliant.

A sense of complacency within the industry could see some businesses leaving their preparations until it’s too late. Doing so has the potential to cause upheaval to your operations, impact ongoing projects and increase the level of risk faced by your organisation.

Together with our experts, we can work with you to communicate these changes to your workforce, develop good housekeeping procedures to effectively analyse and manage your contingent labour and implement an independent IR35 testing tool that can successfully determine the status of your contractors and minimise the risk to your business. Our advice is to act now.